Devault - Budgeting app

Google certificate course - case study

To design a user-friendly budgeting app that helps individuals effectively manage their personal finances by tracking income, expenses, assets, and liabilities.

Role

UX designer

Timeframe

Jan - May/2024

Target audience

Young professionals and individuals looking for an intuitive and efficient way to monitor and control their personal budgets.

Participation

UX research

User journey

Empathy map

Many individuals struggle with financial planning due to the lack of accessible, simple, easy to understand, and engaging tools that cater to their unique budgeting needs. Existing apps often have a steep learning curve or lack features tailored for beginners in financial management.

User flow

Sitemap

Wireframe

The Problem

Design system

Empathize: Conduct user research through interviews and surveys to understand pain points in financial management.

Define: Create user personas and define the core problem statement.

Ideate: Develop potential solutions and sketch wireframes.

Prototype: Build interactive prototypes using Figma.

Test: Perform usability testing and refine the app based on user feedback.

User testing

Prototype

Design iteration

Design process

User persona

RESEARCH

Focus group interview

Hypothesis statement

In order to inform the design process from the perspective of the end user I conducted survey questionnaire with 10 users and interviewed 5 out of them using focus group interview method.

Click here to see research questions.

Highlighted results

Tracking.

Most users expressed difficulty maintaining consistent financial tracking, citing lack of time and motivation.

Unexpected expenses.

4 out of 5 users frequently struggle with unexpected expenses disrupting their budgets.

Complexity.

All users found existing apps either too complicated or cluttered, with unnecessary features that made them less usable.

Lack of personalization.

Users want apps tailored to their specific financial situations, such as student loans or saving for specific goals.

Assets and liabilities tracking.

4 out of 5 users were enthusiastic about having a feature to track assets (e.g., savings, investments) and liabilities (e.g., loans, credit card debt).

Goal setting.

All users emphasized the importance of setting and tracking financial goals, with clear progress indicators.

Helpful reminders.

Notifications about bill payments and goal progress were universally appreciated.

Avoid overload.

Users cautioned against excessive notifications, which they found stressful in other apps.

Ease of use.

Simplicity in design was the top priority for all users. They want an intuitive app that minimizes manual input.

Trust and Security.

Users expressed concerns about data privacy and emphasized the need for secure handling of sensitive financial information.

Consistency motivation.

Gamification elements (e.g., rewards for achieving goals) and regular progress updates were suggested as ways to encourage consistent use.

Low effort.

Users were willing to spend 5–10 minutes per day or 30 minutes per week updating and reviewing their finances.

Problem statement

Eric is a young associate who needs an intuitive and comprehensive budgeting app to manage his finances because he feels overwhelmed by complex tools, struggles to track spending across multiple methods, and worries about unexpected expenses disrupting his savings. The solution should simplify financial tracking, offer actionable insights, and include features like asset and liability management to help Eric confidently achieve his financial goals.

Goal statement

Pain points

Empathy map

If we build an intuitive and comprehensive budgeting app with simplified financial tracking, actionable insights, and features like asset and liability management then it will help Eric effectively manage his finances, reduce anxiety about unexpected expenses, and confidently achieve his savings and financial goals.

Design a user-friendly budgeting app that simplifies tracking, offers actionable insights, and includes asset and liability management to help Eric confidently manage his finances and achieve his goals.

Complex Financial Tools:

Existing budgeting apps are overly complicated, with cluttered interfaces and features he doesn’t need.

Tracking Challenges:

Difficulty in consistently tracking income and expenses, especially across multiple payment methods like credit cards, debit cards, and digital wallets.

Unexpected Expenses:

Anxiety about unplanned expenses disrupting his budget and savings goals.

Limited Insights:

Struggles to get clear, actionable insights on how to adjust spending habits or improve his financial health.

Managing Assets and Liabilities:

Feels overwhelmed trying to track assets (like savings) and liabilities (like student loans) in one place.

Time-Consuming Processes:

Finds it tedious to manually input and categorize transactions or update financial details regularly.

Lack of Goal Clarity:

Has trouble setting and tracking progress toward financial goals, making it harder to stay motivated.

Overwhelming Notifications:

Distracted or frustrated by excessive or irrelevant alerts in existing financial tools.

Visual Overload:

Graphs and charts in other apps are too complex, making it hard for him to quickly interpret his financial status.

Confidence Gap:

Feels uncertain about his financial knowledge and wants a tool that simplifies concepts to boost his confidence.

User persona

User story

As a young associate, Eric wants a simple budgeting app with tools to track his finances, manage assets and liabilities, and get actionable insights, so that he can confidently manage his money and achieve his financial goals.

Happy path

Edge cases

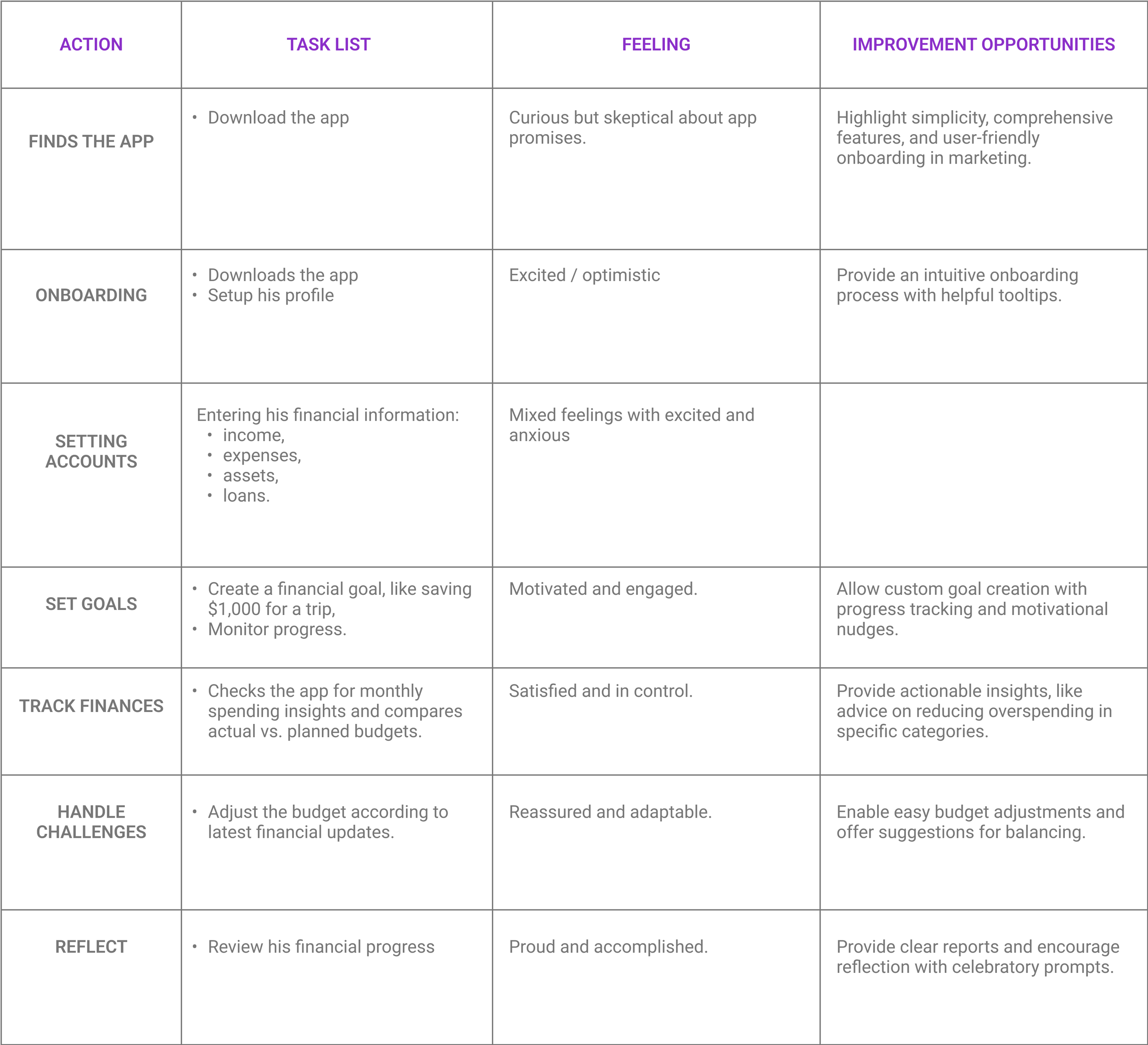

User journey map

Unusual or Unexpected transactions

App performance issues

Data input error

Connectivity challenges

Privacy and security

Goal setting limitations

Feature gaps or misuse

Data visualization error

Accessibility issues

IDEATION

Expense Tracking: Categorize and log expenses easily.

Income Management: Monitor various income sources.

Budget Goals: Set and track progress toward monthly or yearly financial goals.

Visual Insights: Graphs and charts to display spending patterns.

Notifications: Alerts for overspending or bill reminders.

Asset Management: Track assets, such as investments, property, and savings, to provide a complete financial picture.

Liabilities Tracking: Monitor debts and other liabilities, helping users manage repayments effectively and reduce financial stress.

Key features

SITEMAP

DEVAULT USER FLOW

DEVAULT USER JOURNEY

Color palette

DESIGN

Early sketches

Wireframing

Buttons

Iconography

DESIGN GUIDELINES

Typography

Main Navigation

Other Components

Drop down

Text fields

USABILITY TESTING

Participants

5 participants with diverse financial management habits (2 regular budgeters, 3 irregular/non-budgeters).

Duration

20 minutes per session.

Method

Moderated, in person usability testing.

Prototype features tested:

Signing up into the app

Financial accounts logging.

Goal-setting flow.

Income and Expense tracking.

Income and Expense logging.

Home dashboard with a financial summary.

New account adding.

New financial goal setting.

Asset and Liability Tracking page.

Use budgeting feature to review.

Key findings and observations:

1. Dashboard Navigation

Success Rate: 5/5 participants.

Feedback:

Participants easily identified key financial summaries.

Suggestion: Add tooltips for icons like “Savings Progress” and “Debt Tracker.”

2. Log an Account

Success Rate: 4/5 participants.

Feedback:

The flow was straightforward, but one participant struggled with selecting the account type.

Suggestion: Provide examples for account types (e.g., “Checking, Savings, Credit Card”).

3. Set a Financial Goal

Success Rate: 3/5 participants.

Feedback:

Participants found the flow confusing, particularly when entering timelines.

Suggestion: Use a calendar picker for goal timelines and pre-fill examples.

4. View Income and Expenses

Success Rate: 5/5 participants.

Feedback:

All participants appreciated the clear categorization but wanted a breakdown of recurring vs. one-time expenses.

5. View Assets and Liabilities

Success Rate: 4/5 participants.

Feedback:

Participants liked the overview but requested visual differentiation (e.g., color coding) between assets and liabilities.

6. Set a New Financial Goal

Success Rate: 3/5 participants.

Feedback:

Same issues as the initial goal-setting task; the process needs more clarity and examples.

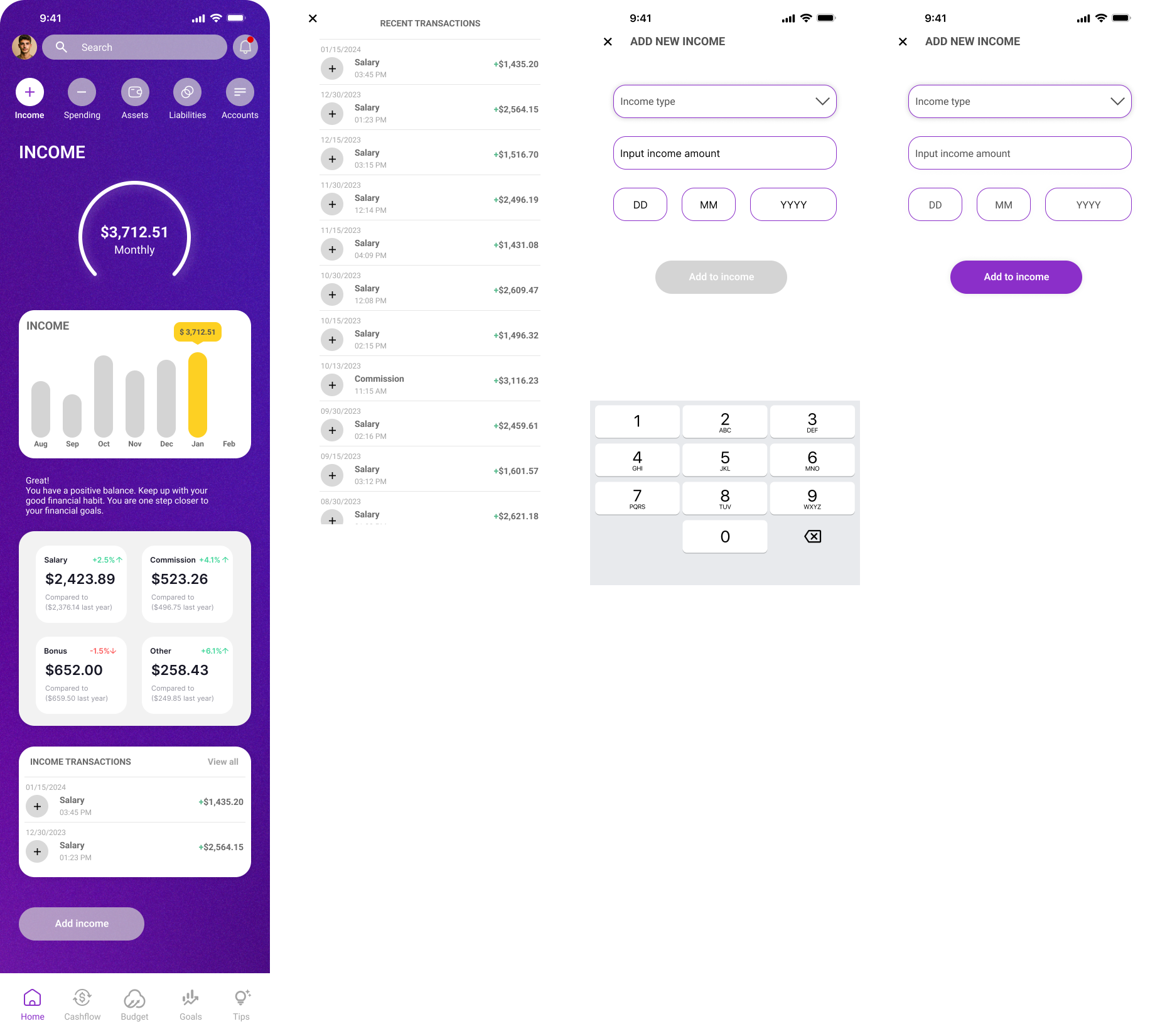

7. Log New Income

Success Rate: 5/5 participants.

Feedback:

Participants found this task simple and intuitive.

8. Log New Expense

Success Rate: 5/5 participants.

Feedback:

The process was clear, but participants wanted an option to add notes (e.g., “Split bill with roommate”).

9. Add a New Financial Account

Success Rate: 4/5 participants.

Feedback:

One participant missed a step when entering the account balance.

Suggestion: Add guidance prompts during input.

10. Budget Your Finance

Success Rate: 5/5 participants.

Feedback:

Participants liked the simplicity but suggested adding a confirmation step to prevent accidental changes.

Metrics summary:

Recommendations:

Tasks assigned to participants:

Explore Dashboard:

Navigate the home dashboard and identify the overall financial summary.Log an Account:

Add a new financial account (e.g., checking or savings).Set a Financial Goal:

Create a goal to save $1,000 in six months.View Income and Expenses:

Access the income and expenses breakdown for the current month.View Assets and Liabilities:

Locate and review the summary of assets and liabilities.Set a New Financial Goal:

Add a second financial goal (e.g., save $500 for a trip).Log New Income:

Record a paycheck of $2,500.Log New Expense:

Record a grocery expense of $75 and categorize it.Add a New Financial Account:

Add a credit card account with an outstanding balance of $1,200.Budget Your Finance:

Adjust the monthly budget for “Entertainment” by increasing it by $50.

Dashboard Enhancements:

Add tooltips and improve visual clarity for icons.

Financial Goal Setting:

Simplify the timeline input by incorporating a calendar picker and pre-filled examples.

Expense Logging:

Add a “notes” field for additional context on transactions.

Account Logging:

Provide examples of account types and clearer input guidance.

Assets and Liabilities:

Introduce color coding for differentiation and provide brief explanations for these terms.

Budget Adjustments:

Add a confirmation step before saving budget changes to prevent accidental edits.

HIGH FIDELITY DESIGN

Main flow

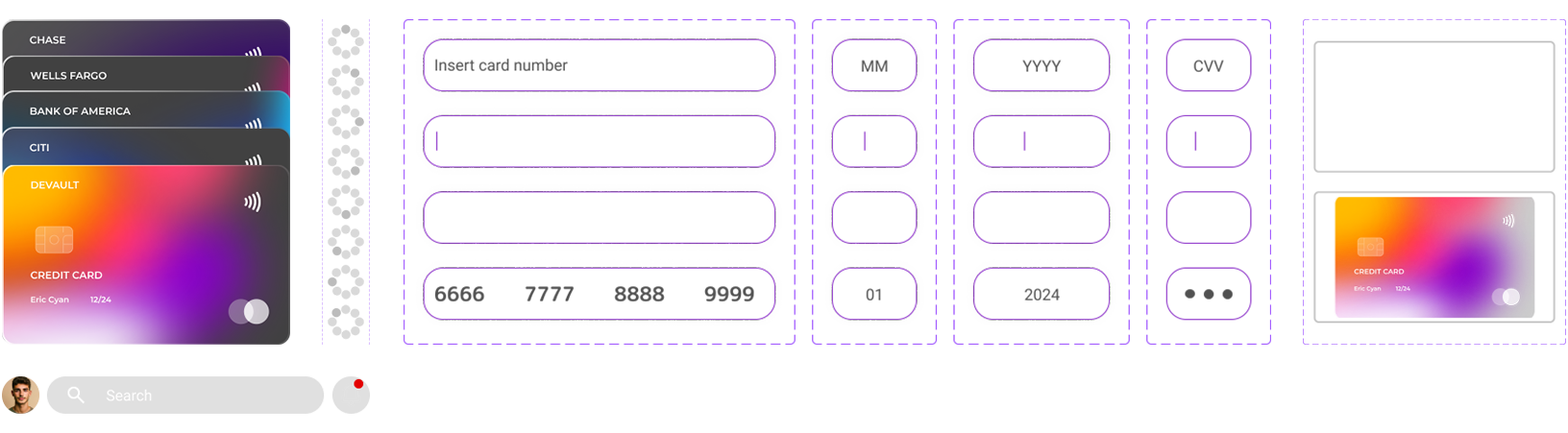

Account adding

Goal setting

Income

New account adding

Budgeting

Onboarding

Key takeaways from my

Google Certificate - UX project

Spending

Tips

User-Centered Design is Crucial:

I learned how important it is to deeply understand user needs, goals, and frustrations through methods like surveys, interviews, and usability testing. Personas and user journeys became essential tools for empathizing with my audience.

The Value of Iteration:

Starting with low-fidelity prototypes and refining them based on feedback taught me the importance of iterating early and often. It’s better to make mistakes in the beginning than later in the process.

Keeping it Simple and Accessible:

Designing for people with different financial habits helped me realize the need for clear navigation, intuitive workflows, and inclusive language to create a seamless user experience.

Improving Communication Skills:

Documenting each phase of the project strengthened my ability to explain my design decisions clearly, a skill I know will be valuable in team settings.

Problem-Solving Beyond Interfaces:

I discovered that good UX design isn’t just about visuals—it’s about solving real problems. Tackling something as complex as financial management taught me to simplify processes for users while balancing functionality.

The Power of Usability Testing:

Conducting in-person moderated testing showed me how valuable direct user feedback is. It uncovered issues I hadn’t noticed and made the app better.

Sharpening My Skills:

This project allowed me to combine what I already knew—like research and creative writing—with new skills in UX design, making me more well-rounded as a designer.

Designing with Empathy:

Working on an app for personal finance reminded me to think beyond functionality. I had to consider the emotional impact of my design and create something that feels supportive, not overwhelming.

Building Confidence:

Completing this project from start to finish has boosted my confidence as a UX designer. It feels great to see how much I’ve grown through this process.

A Strong Foundation for the Future:

This project has laid the groundwork for me to tackle more complex challenges in the future. I’m excited to keep improving and applying what I’ve learned.